Auto depreciation calculator for taxes

1 Credit and collateral subject to approval. Loan interest taxes fees fuel maintenance and repairs.

Macrs Depreciation Calculator Irs Publication 946

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

. It can be used for the 201314 to. Cost x Days held 365 x 100 Effective. This calculator may be.

Car Depreciation Calculator. Loan must be open for at least 60 days with. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

Cost of Running the Car x Days you owned 365 x. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for.

Ad Our Resources Can Help You Decide Between Taxable Vs. Edmunds True Cost to Own TCO takes depreciation. Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership.

Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation. Using the Car Depreciation calculator. Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More.

To calculate the depreciation of your car you can use two different types of formulas. Check Out How Much Members Can Save--Finally Stop Dreaming and Start Driving. Ad Auto Loans With Great Rates 100 Financing Exclusive Military Discounts.

Table 2 provides depreciation deduction limits for passenger automobiles placed in service by the taxpayer. The Car Depreciation Calculator uses the following formulae. We will even custom tailor the results based upon just a few of.

The MACRS Depreciation Calculator uses the following basic formula. Where A is the value of the car after n years D is the depreciation amount P is the purchase. Existing Navy Federal loans are not eligible for this offer.

MACRS Depreciation Calculator Help. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Auto refinance loan must be at least 5000.

Calculate the cost of owning a car new or used vehicle over the next 5 years. The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle. Using the values from the example above if the.

This calculator will calculate the rate and expense amount for personal or real property for a given. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200. Prime Cost Method for Calculating Car Depreciation. 3rd Tax Year 10800 Each Succeeding Year 6460.

To calculate your deduction multiply the number of. Everything is included Premium features IRS e-file Itemized Deductions. A P 1 - R100 n.

Work-related car expenses calculator. Above is the best source of help. D P - A.

The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. We base our estimate on the first 3 year.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

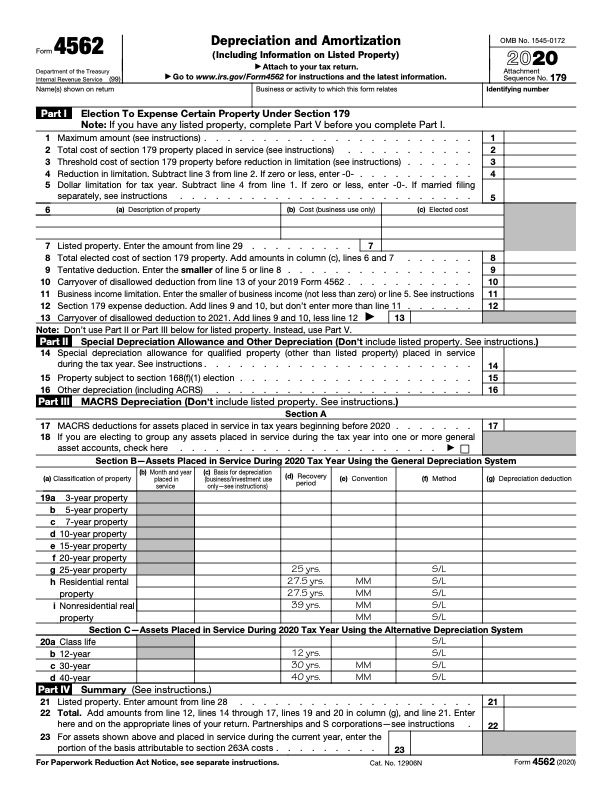

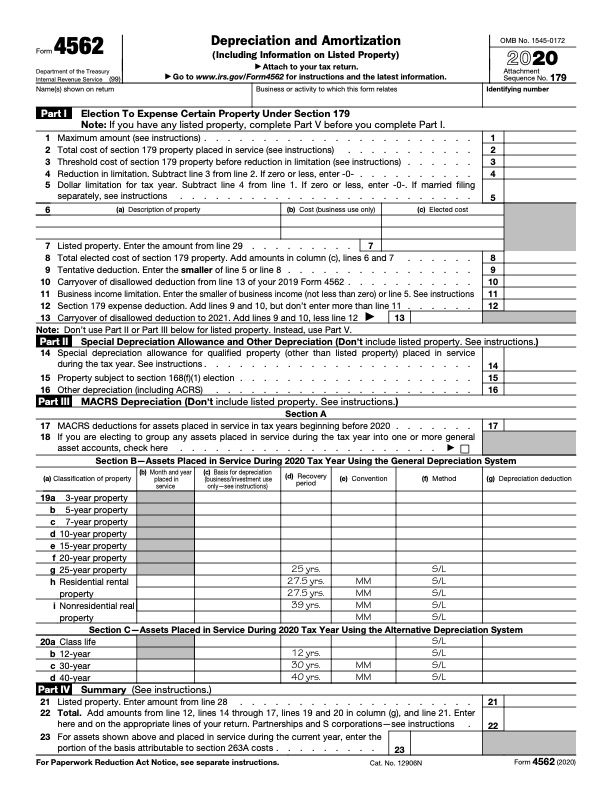

Form 4562 Depreciation And Amortization Definition

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Home Office Expense Spreadsheet Spreadsheets Offered Us The Probable To Input Transform And Tax Deductions Free Business Card Templates Music Business Cards

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Rate And Idv Calculator Mintwise

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Calculator

Depreciation Calculator Depreciation Of An Asset Car Property

The Cost Of Car Ownership Is Rising Infographic Infographic Car Cost Financial Literacy

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Macrs Depreciation Calculator Irs Publication 946

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Based On Irs Publication 946